It’s a good idea to review quarterly financial outcomes to assess how well a business is doing, particularly when benchmarked against others within the same field. In this report, we will examine Sabre (NASDAQ:SABR), along with identifying which companies stand out as top and bottom performers in the realm of travel and vacation services.

Airline companies, hotels, resorts, and cruise lines frequently offer experiences instead of physical goods. Over the past ten years, people have gradually moved away from purchasing “stuff” (often wasteful) towards acquiring “experiences” (which tend to be more memorable). Moreover, the internet has brought about fresh methods for managing leisure activities and accommodation bookings, including options like renting houses or making arrangements for extended stays. To remain competitive in an industry brimming with innovations, traditional players such as airlines, hotels, resorts, and cruise lines need to adapt and evolve their offerings.

The 19 travel and vacation provider stocks we monitor showed varied performance for Q1. Collectively, their revenues surpassed analyst expectations by 0.6%, whereas their forecast for the following quarter’s revenue came in at 4.6% higher than anticipated.

Fortunately, the stock prices of these firms have shown resilience, increasing by an average of 9.7% since their most recent financial outcomes were released.

Sabre (NASDAQ:SABR)

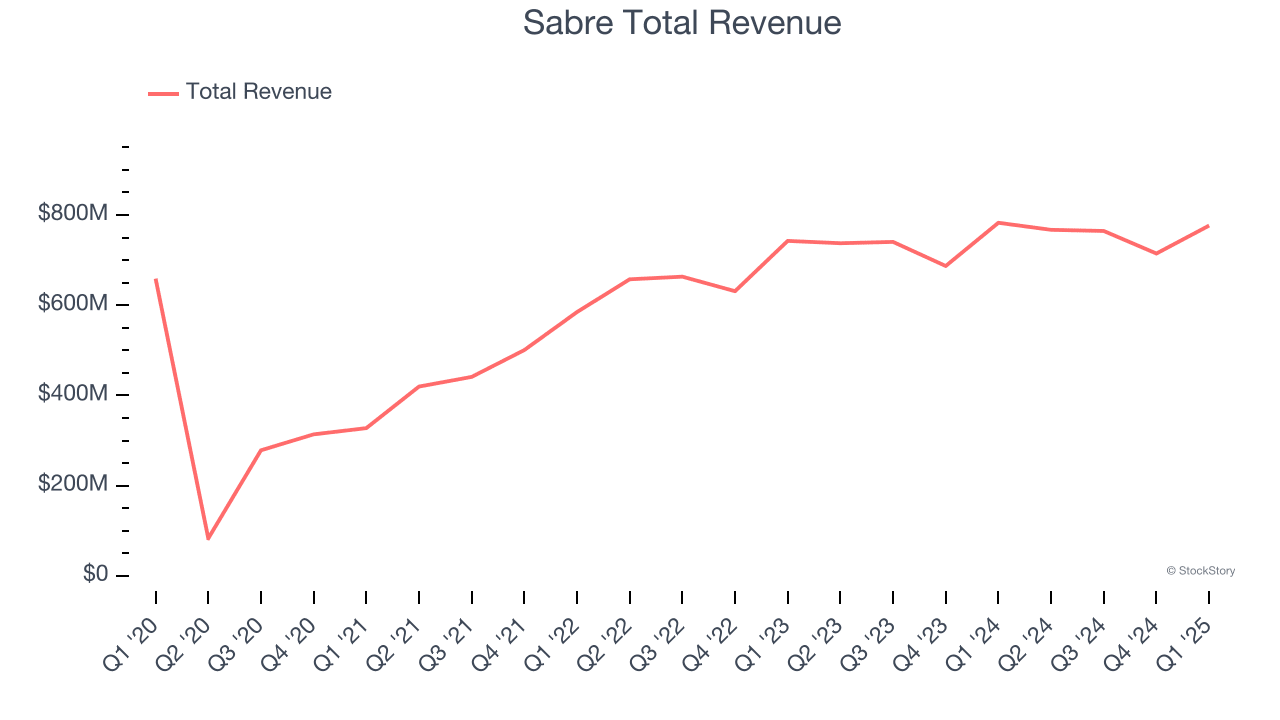

Initially part of American Airlines, Sabre (NASDAQ:SABR) serves as a technological backbone for the worldwide travel and tourism sector.

Sabre announced revenues of $776.6 million, which remained unchanged compared to last year. The report missed analyst predictions by 2.3%, making this a less robust period for the business overall. They notably did not meet expected earnings per share (EPS) forecasts, and their projected EBITDA also failed to align with what financial experts had anticipated for the following quarter.

The share price has increased by 6.9% since the report was released and is now trading at $2.63.

Check out our comprehensive report on Sabre here; it’s free.

.

Best Q1: Lindblad Expeditions (NASDAQ:LIND)

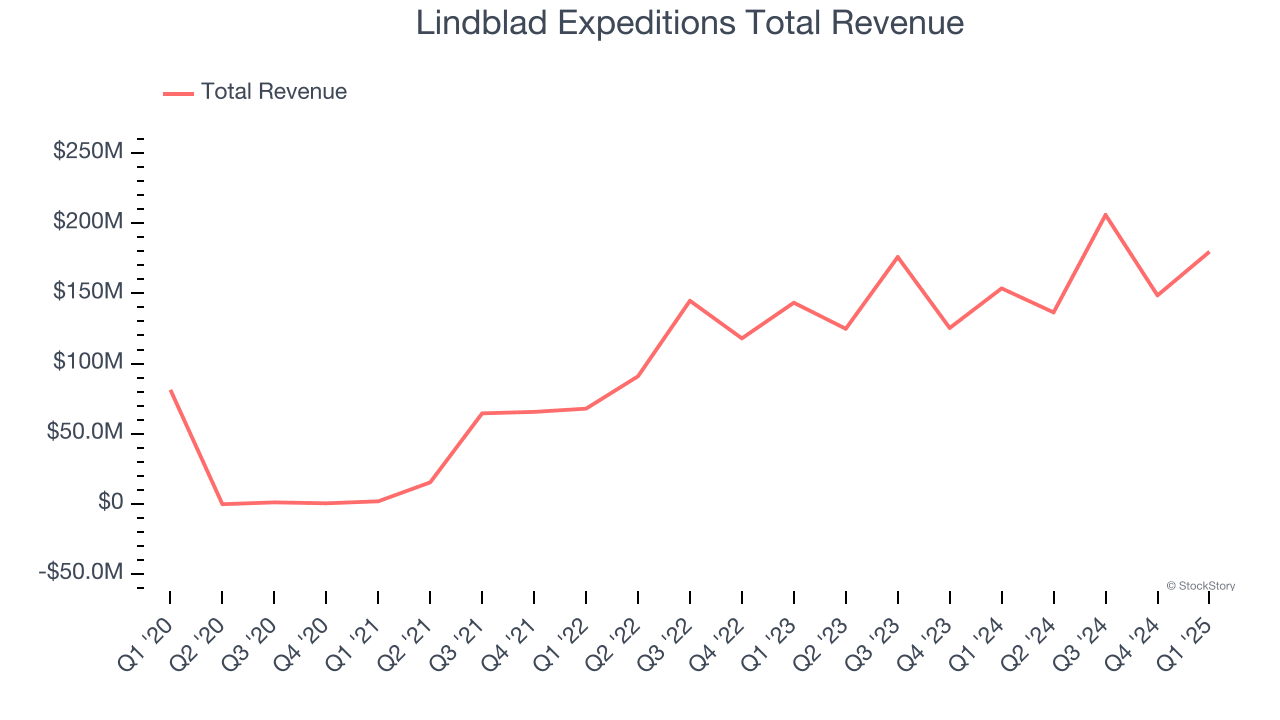

Lindblad Expeditions (NASDAQ:LIND), established by explorer Sven-Olof Lindblad in 1979, provides voyages to far-off locations in collaboration with National Geographic.

Lindblad Expeditions announced revenues of $179.7 million, marking a rise of 17% compared to the previous year, surpassing analyst predictions by 18.8%. This period was particularly strong for the company as they not only exceeded expected earnings per share (EPS) but also significantly surpassed projected EBITDA figures.

Lindblad Expeditions surpassed the largest analyst predictions, achieved the most rapid increase in revenue, and provided the highest upward revision for annual forecasts compared to similar companies. This positive performance has pleased investors, leading to an uptick of 12.7% in their stock price following the report. At present, the share value stands at $10.27.

Is this the right moment to purchase shares in Lindblad Expeditions?

Check out our comprehensive analysis of the earnings results here; it’s free.

.

Hilton Grand Vacations (NYSE:HGV)

Spun off from Hilton Worldwide in 2017, Hilton Grand Vacations (NYSE:HGV) is a global timeshare company that provides travel experiences for its customers through its timeshare resorts and club membership programs.

Hilton Grand Vacations reported revenues of $1.15 billion, flat year on year, falling short of analysts’ expectations by 7.6%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

Hilton Grand Vacations showed the poorest performance compared to what analysts had forecasted within the group. Notably, despite these results, the stock has risen by 14.8% since then and is presently trading at $38.59.

Check out our comprehensive review of Hilton Grand Vacations’ performance here.

Wyndham (NYSE:WH)

Founded in 1981, Wyndham (NYSE:WH) operates as a worldwide hotel franchise corporation boasting more than 9,000 properties spanning almost 95 nations across six continents.

Wyndham announced revenues of $316 million, representing a 3.6% increase from the previous year. This figure matched the projections made by financial analysts. Overall, it was a varied quarter since although they surpassed analyst EPS forecasts considerably, they fell short of predictions for adjusted operating income.

The stock has remained stable since the report and is presently trading at $85.08.

Check out our comprehensive, practical report on Wyndham for free right here.

Carnival (NYSE:CCL)

With over-the-top features such as a planetarium onboard their vessels, Carnival (NYSE:CCL), a major figure in the global leisure travel sector, stands out prominently within the cruise business.

Carnival announced revenues of $5.81 billion, marking a rise of 7.5% compared to the previous year. This figure exceeded analyst predictions by 0.9%. The company had a robust quarter overall, not only surpassing analysts’ earnings per share forecasts but also delivering a notable margin above their adjusted operating income projections.

The share price has increased by 5.7% since their report and is now trading at $22.40.

Check out our comprehensive, practical report on Carnival—it’s available at no cost.

Market Update

Due to the Federal Reserve’s interest rate increases in 2022 and 2023, inflation has dropped from peak pandemic levels. As of recently, we’ve seen prices of goods and services moving closer to the Fed’s target of 2%, which is positive news. Although these high-interest rates were aimed at curbing inflation, they did not hinder economic growth sufficiently to trigger a recession. Thus far, this approach seems to be achieving what economists call a “soft landing.” Additionally, the recent reductions in interest rates—a half-point cut in September 2024 followed by another quarter-point reduction in November—have contributed significantly to robust stock market gains throughout 2024. Adding further fuel to the year-end rally was Donald Trump’s win in the U.S. presidential race earlier in November, pushing key indexes to record-highs during the subsequent weeks. However, discussions about the overall state of the economy persist alongside concerns over possible tariffs and changes in corporate taxes, casting doubt on future prospects for 2025.

Interested in investing in successful companies with strong foundations? Explore our recommendations.

Top 5 High-Quality Compounder Stocks

And include them in your watchlist. These firms are expected to grow irrespective of the political landscape or broader economic conditions.

Become a Member of our Paid Stock Investor Research Group

Assist us in enhancing StockStory’s value for investors such as you. Participate in our compensated user research session and get a $50 Amazon gift card for sharing your insights.

Sign up here

.

Leave a Reply