Delta Air Lines ( DAL ) anticipates a slight increase in demand in the latter part of the year following the tariff-related downturn, according to CEO Ed Bastian who shared this with Bloomberg TV.

“There’s no doubt that in the near term, considering what has emerged from Washington and the complexities of ongoing trade talks, things appear quite turbulent,” Bastian stated during the interview.

I don’t believe that will endure for long. We are making progress and reaching a point of greater stability.

While 2025 started on a bright note for airline companies with demand picking up pace, economic uncertainties tempered consumer sentiment, forcing Delta and its peers to curtail capacity.

Bastian said Delta grappled with weakness in bookings earlier this year, predominantly in the U.S. market and among leisure travelers in its main cabin.

He reportedly added that North Atlantic travel routes are doing well, and while there’s some weakness in the main coach cabin, yields on premium air tickets remain strong.

The airline also launched a partnership with India’s largest airline, Indigo, and said it expects to resume direct flights between Delhi and Atlanta soon.

A global tariff war has also sparked concerns over who absorbs the cost of tariffs. Delta and Airbus have indicated that neither wants to pay for the levies.

We have a strong partnership with Airbus,” Bastian stated. “This period will eventually end, and a new global arrangement of sorts will emerge.

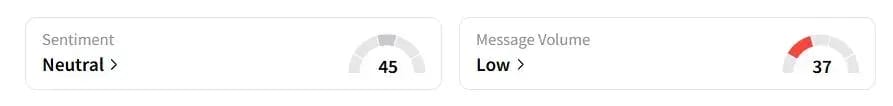

The mood of retailers was ‘neutral’ at 45 out of 100, with conversations among them being quite ‘minimal.’

Delta Air Lines’ stock

has dropped 19.7% year-to-date (YTD).

Also See:

CLF, STLD, NUE, X: Steel Stocks Gain Attention Following Trump’s Tariff Increase to 50%, Positive Outlook for Retail

To request updates or corrections, send an email to newsroom@[dot]com.

Leave a Reply