Certain credit card sign-ups provide

instant approval

, which is fantastic. However, what’s truly excellent is receiving immediate access to your new credit card.

Immediate access to your new card number enables you to begin fulfilling the spending criteria needed to earn rewards from that card.

welcome bonus

Ultimately, the timer for welcome bonuses begins the moment your account is approved, rather than when you get your card in the mail and activate it.

It’s also a valuable aspect when you’re applying for a card that has an intro offer.

0% introductory APR offer

which could be useful if you plan to finance a significant purchase soon.

This indicates that obtaining immediate access to your new credit card could afford you an extra one to two weeks to strive for its bonus.

Let’s examine different credit card providers to determine which ones provide immediate virtual card numbers after approval.

Our recommended choices for cards featuring immediate card numbers

With an instant card number, you can begin utilizing your new card right away. This gives additional time to focus on accruing the card’s welcome bonus.

In the case of

store-brand credit cards

Additionally, you might qualify for discounts on your buys once you begin utilizing the card. Keep in mind that certain providers, such as Chase, permit you to link your card to a digital wallet without providing an immediate card number.

Although there are numerous cards available that provide virtual card numbers or immediate access, these are seven of our top choices.

|

Card |

Welcome offer |

Annual fee |

Earnings rate |

Best for |

Degree of immediate card accessibility |

|---|---|---|---|---|---|

|

The American Express Platinum Card® |

Receive 80,000 bonus points when you spend $8,000 on purchases during your initial six months as a cardholder.

Nevertheless, you could be chosen for a more elevated welcome bonus through the |

$695 (see rates and fees ) |

|

Access to premium lounges plus additional lifestyle perks (certain benefits require enrollment) | This offers access to the complete card number along with the capability to link it to digital wallets. |

|

American Express® Gold Card |

Receive 60,000 bonus points when you spend $6,000 on purchases during your initial six-month period as a cardholder.

Nonetheless, you could be chosen for a more generous welcome offer through the |

$325 (see rates and fees ) |

|

Eating at restaurants around the globe and grocery shopping at U.S. markets | This offers access to the complete card number along with the capability to add it to digital wallets. |

|

Capital One Venture X Credit Card |

Receive 75,000 bonus miles when you spend $4,000 on purchases within the initial three months of opening your account. | $395 |

|

Easy accumulation of mileage points and entry to lounges | Approved cardholders can get immediate access through the Capital One app and link their card to a digital wallet. |

|

Capital One Venture Rewards Credit Card |

Receive 75,000 bonus miles when you spend $4,000 on purchases in the initial three months after opening your account.

In addition, you will get a $250 Capital One Travel credit that can be used throughout your first year as a cardholder after opening your account. |

$95 |

|

Travel benefits at a small yearly charge | Approved cardholders can get immediate access through the Capital One app and add their card to a digital wallet. |

|

Chase Sapphire Preferred® Card (see rates and fees ) |

Receive 100,000 additional reward points when you spend $5,000 within the initial three months of opening your account. | $95 |

|

Travel perks featuring multiple special tiers | It offers the capability to add your card to digital wallets via Spend Instantly. |

|

Chase Sapphire Reserve® (see rates and fees ) |

Receive 60,000 bonus points when you spend $5,000 within the initial three months of opening your account. | $595 |

Points from travel purchases are obtained following the use of the $300 yearly travel credit. |

Premium travel rewards | This feature enables you to add your card to digital wallets for instant spending. |

|

Bilt Mastercard® * |

None |

$0 (see rates and fees ) |

|

Earning points on rent | It provides immediate access to the card number along with the capability to add it to digital wallets. |

Brian Kelly, the founder of TPG, serves as an advisor and investor for Bilt.

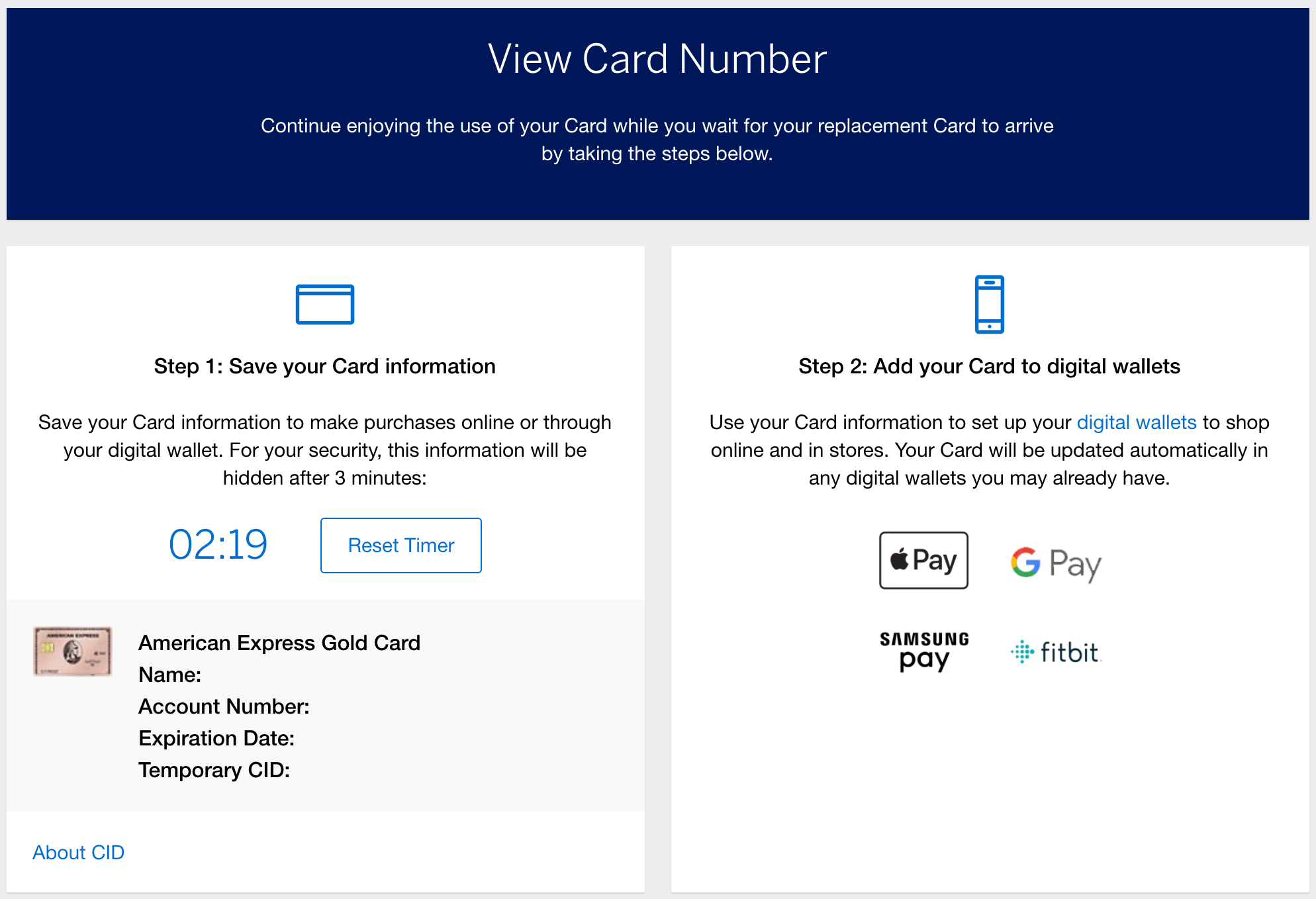

American Express

When American Express approves your online application and verifies your identity, they will provide your new account number right away. In the past, once you closed the page showing your card details, you were unable to see the number again unless you took a screenshot or jotted it down manually. Nevertheless, certain customers have reported receiving emails from Amex enabling them to access their instant card number once more when requested.

The virtual card number will match the one sent to your address via post; however, the four-digit card verification number displayed on the face of the card will vary. Therefore, consider avoiding the use of this card for automatic transactions.

Please be aware that for certain co-branded credit cards, the instant card number can only be utilized with the specific co-branded partner such as Hilton or Marriott.

Besides providing immediate numbers to new cardholders, American Express also grants current cardmembers access to their card details during the process of obtaining replacements.

Related:

Selecting the ideal American Express card for your needs

If you aren’t keen on obtaining your card number right away, it’s still advisable to ask for one when the system prompts you. Every Amex individual and company credit card provides an immediate card number option, with the exception of the Amazon Business Card and the Amazon Business Prime Card.

The data regarding the Amazon Business and Amazon Business Prime credit cards has been gathered separately by The Points Guy. Please note that the specifics of these cards presented here were neither examined nor supplied by their issuing entity.

A few of our favorite choices are:

- Amex Platinum Card

- Amex Gold Card

- Blue Cash Preferred® Card by American Express

- Hilton Honors Aspire Card

The data regarding the Hilton Amex Aspire card was gathered independently by The Points Guy. The specifics of the card featured on this page were neither reviewed nor supplied by the card issuer.

Related:

The strength of the Amex Trifecta

Bank of America

The sole Bank of America card that always provides an immediate card number is the

Alaska Airlines Visa Signature® credit card

.

Sometimes, people who have Bank of America checking accounts might get a specific offer providing them with an immediate card number for their cards such as the

Bank of America® Premier Rewards Credit Card

However, this does not follow the usual procedure.

The Alaska Airlines Visa Signature card provides an attractive welcome bonus along with some of the most rewarding airline miles available. Additionally, using this card to cover your travel expenses will grant you complimentary first-checked baggage as well as expedited boarding privileges.

To get more information, check out our comprehensive review of the

Alaska Airlines Visa Signature credit card

.

Related:

Top Bank of America Credit Cards

Barclays

Barclays does not provide instant card numbers. Nevertheless, you might have

ability to use your card’s credit cap

(if you apply for a Barclays-issued card during the booking process without accessing the card number itself)

Examples include the

Frontier Airlines World Mastercard®

,

Holland America Line Rewards Credit Card

and

JetBlue Card

If you apply for and get approved for these cards when making a reservation, you might have the option to pay for your trip using the newly issued card; however, this card can only be used for payments related to the booking.

The data regarding the Frontier Mastercard, Holland America Visa, and JetBlue cards has been gathered separately by The Points Guy. Please note that the specifics of these credit cards presented here were neither examined nor supplied by their respective issuers.

Capital One

It could potentially allow you to utilize your Capital One card number right away; however, this isn’t available for all individuals. To gain immediate access to such functionality, you need to be a current customer of their services and also make use of the Capital One mobile application.

Observe that this is different from the

virtual card numbers

offered by Capital One.

A few of our premier choices for Capital One credit cards providing immediate card numbers to qualifying applicants include:

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Capital One Quicksilver Cash Rewards Credit Card

Related:

Capital One Venture compared with Venture Rewards

Cardless

Cardless

centers around co-branded credit cards that you can utilize without requiring the actual card itself, right after getting approved for an account and during the entire duration of the card’s lifespan. Using the Cardless application, you have access to these co-branded cards and can obtain a fresh card number promptly within the app should your card be compromised at any point.

Cardless offers co-branded credit cards for brands such as Simon Property Group.

Avianca

and LATAM Airlines.

Chase

It is feasible to utilize widely-used Chase credit cards — such as the

Chase Sapphire Preferred

,

United℠ Explorer Card

(see

rates and fees

) and

Hyatt Credit Card

(see

rates and fees

— immediately after account approval by adding these cards to a digital wallet via Spend Instantly.

It should be noted that this feature doesn’t provide a method for obtaining an immediate card number; rather, it enables you to swiftly add your card to a digital wallet.

Below are the instructions for setting up Spend Instantly.

- Open the Chase app.

- Head over to your credit card account.

- Go to account services, and click on digital wallets.

- Next, select which mobile wallet you wish to link your card to. By following these instructions, you’ll be ready to utilize your card with retailers that support digital wallets.

Nevertheless, the issuer points out that there are multiple cards you

cannot use instantly

including Mastercard gift cards, Amazon gift cards, and business cards.

Related:

The best Chase cards

Citi

If your application for a Citi credit card gets approved immediately and your identity is confirmed, they will provide an instant card number. Keep in mind that you get only one chance to see this number, so make sure to jot it down.

Furthermore, immediate availability of virtual credit card numbers is not an option.

small-business

or

American Airlines credit cards

According to statements from a Citi representative, some users have mentioned not being able to obtain an instant card number with certain cards such as the

Citi Double Cash® Card

(see

rates and fees

)

Should your credit card application get approved right away, you have the option to click “Obtain Card Number Now” for immediate access to your new card’s temporary identification. However, some verification might still be necessary before obtaining this instant card number.

After observing a green tick symbol, proceed by clicking “View Card Summary” to examine your provisional card number along with the card security code. Keep in mind though; you will not be able to utilize the entire credit limit of this card until after receiving its tangible form.

Nevertheless, usually just a limited number of cards provide you with access to your temporary card number. These include:

- AT&T Points Plus℠ Card

- Citi Custom Cash® Card

-

Costco Anywhere Visa® Card from Citi

(see

rates and fees

)

It should be noted that you can only use instant access for purchases through AT&T when using the AT&T Points Plus card, and similarly, you can do so at Costco with the Costco Anywhere Visa. However, this immediate purchase option isn’t offered by other retailers for these specific credit cards.

The data regarding the AT&T Points Plus Card and Citi Custom Cash was gathered independently by The Points Guy. Please note that the specifics of these cards presented here were neither examined nor supplied by their respective issuers.

Related:

The top Citi credit card options

Discover

Discover frequently provides you with immediate approval decisions regarding your application for a credit card. If qualified, after receiving this verdict, you may obtain a virtual card number to utilize online or integrate into a digital wallet.

The

Find out about the Discover it® Cash Back Credit Card

It tops our list. This card is ideal for newcomers, providing an unrestricted cashback matching program during the initial year along with changing 5% quarterly cash-back categories.

The data regarding the Discover it Cash Back card was gathered independently by The Points Guy. The specifics of the card mentioned on this page have not been examined or supplied by the card issuer.

Goldman Sachs

Goldman Sachs permits you to utilize the

Apple Card

immediately using Apple Pay once your account is approved. A physical card is entirely optional.

The Apple Card is a great choice because it doesn’t have an annual fee and offers at least 2% cashback on everything you buy using Apple Pay. Additionally, you can access your cash-back rewards immediately following each transaction.

The information about the Apple Card was gathered independently by The Points Guy. The specifics of the card mentioned on this page were neither reviewed nor supplied by the card issuer.

SoFi

SoFi’s credit cards provide immediate access to a digital card, with the physical ones being delivered via mail within 10 business days. The cards come with these features:

- SoFi Unlimited Credit Card

- The SoFi Everyday Cash Back Credit Card

- SoFi Essentials Credit Card

The initial two choices provide excellent cashback benefits. SoFi Unlimited provides an unrestricted 2% cash back on every purchase made. On the other hand, SoFi Everyday gives you the potential for up to 3% extra cash back across multiple categories such as restaurants, supermarkets, and even online food shopping services.

The data regarding the SoFi Unlimited Credit Card, SoFi Everyday Cash Rewards Credit Card, and SoFi Essentials Credit Card was gathered separately by The Points Guy. Please note that the specifics of these cards presented here were not reviewed or supplied by their respective issuers.

Related:

The top 2% cash-back credit card options

Synchrony

There are two Synchrony cards that you can utilize right after getting approved. Nonetheless, these cards can only be used instantly through digital wallets or via their specific apps such as PayPal for the

PayPal Cashback Mastercard®

) and Venmo (for payments).

Venmo Credit Card

).

You have to await the arrival of your card via post before you can use it for transactions with other retailers.

The data regarding the PayPal Mastercard and Venmo Credit Card has been gathered separately by The Points Guy. Please note that the specifics of these cards presented here were not examined or supplied by their respective issuers.

US Bank

U.S. Bank generally provides immediate card numbers solely to customer cardholders who have confirmed their identities and established a banking history with the bank. The institution also features several impressive cash-back credit card options.

A few solid choices to think about include:

- The U.S. Bank Altitude Go Visa Signature Card

- The U.S. Bank Altitude® Connect Visa Signature® Card

The data regarding the U.S. Bank Altitude Go and U.S. Bank Altitude Connect Visa Signature Cards was gathered separately by The Points Guy. Please note that the specifics of these cards presented here were neither examined nor supplied by their issuing bank.

Wells Fargo

Although most of the credit cards issued by Wells Fargo do not provide immediate card numbers, the

Bilt Mastercard

is an exemption and does not have an annual fee (refer to

rates and fees

The Bilt Mastercard stands alone because of its exceptional capability to accumulate bonus points on rent payments (up to 100,000 annually; ensure you use the card five times per billing cycle for point earnings) with no extra transaction charges attached (refer

rates and fees

).

You will be able to get immediate access to your card number through the Bilt Rewards application.

To learn more, check out our comprehensive review of the

Bilt Mastercard

.

FAQs

What exactly is rapid acceptance for credit cards, and what’s the process behind it?

Once you submit an application for a credit card, it gets evaluated by a computer system. Usually, you will get one out of these three replies: instant acceptance, a version of “under review” status, or rejection.

Getting immediate approval does not ensure that you will start using your card instantly. Upon receiving quick acceptance, you might have the chance to see your card number at once; however, typically, you must await the arrival of your actual card via post before you can use it.

How long will it be before I receive my new credit card?

It might take between five to ten business days to receive your new credit card once approved. Nevertheless, this timeframe could differ based on the specific card and issuing bank. As an example, American Express employs overnight delivery services specifically for the Amex Platinum. Certain issuers provide accelerated shipping upon request; however, such service isn’t guaranteed. Additionally, you may have to cover extra costs for faster delivery.

Bottom line

Several providers provide fast delivery options for your replacement card. However, typically, you should expect to wait about seven days before receiving your new card via postal mail. Gaining immediate access to your new card’s number can be crucial, particularly when aiming to quickly meet the spending threshold needed to earn an introductory reward as swiftly as possible.

If you urgently require a new credit card, look into the alternatives listed above.

Related:

Interested in getting concert presale access? Avoid being loyal to just one bank.

For Capital One products featured on this page, certain benefits might be offered by Visa® or Mastercard® and can differ based on the specific product. For more information, refer to their individual Benefit Guides, noting that terms and exceptions apply.

To view the rates and fees for the Amex Platinum card, please click.

here

.

To view the rates and fees for the Amex Gold card, please click.

here

.

To view the rates and fees for the Bilt Mastercard, please click.

here

.

To view the rewards and benefits of the Bilt Mastercard, please click.

here

.

Editorial disclaimer: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

Leave a Reply