Nicole Brewer grew up in Detroit without the initial aspiration of living overseas, yet she was quite certain about her desire to explore different places.

Her initial source of motivation was Catherine C. Blackwell, a trailblazer in African and African-American studies, who also lends her name to Brewer’s middle school.

He would visit and share tales of his journeys with us,” Brewer, 43, recounts to Make It. “I thought, Mozambique — that seems like a stunning place… thus, my interest in traveling was ignited from an early age.

Mozambique remains on Brewer’s list—and considering her history, there’s a strong likelihood she will reach that point sooner or later.

In 2008, Brewer initially relocated overseas, and since 2012, she has been living in Nizwa, Oman. According to her, the Middle East serves as an ideal starting point for her two major journeys each year, which have encompassed holidays in places like Europe, Namibia, Seychelles, and more recently, Bali.

However, Brewer is far from being part of the elite jet-set crowd, making roughly $44,000 annually from her roles—teaching English as a second language at a nearby university and engaging in various freelance gigs. Below is her strategy for maintaining her extensively traveled way of life.

She keeps expenses low

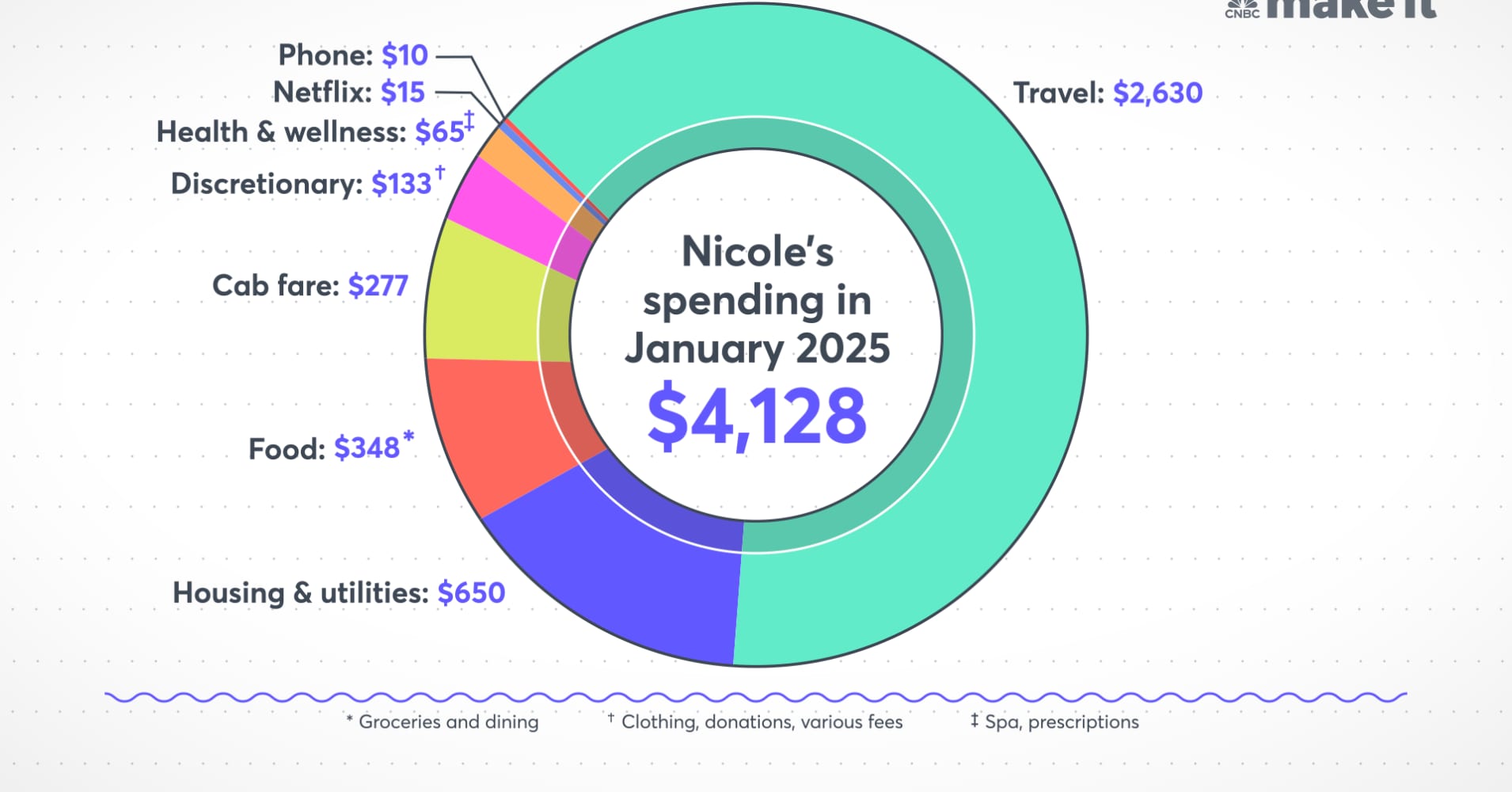

In certain aspects, Brewer’s expenses in January mirror her way of life in Oman quite closely. Out of the total expenditure of $4,128 for that month, $2,630 was allocated towards a journey to Bali. This leaves $1,498 as roughly what she usually spends within an average month, which remains significantly lower than her pre-tax income received from her work as a teacher.

What methods does she use to maintain such a strict budget?

A significantly affordable cost of living definitely aids in this scenario. Brewer spends around $650 each month for a fully equipped two-bedroom, two-bath apartment located within walking distance from her job. The monthly rent covers utilities like electricity, water, and internet access.

Brewer mentions, “The sole expense I have beyond that is my monthly cell phone bill,” which amounts to $10 per month.

She typically budgets around $70 to $80 each week for grocery shopping and occasionally enjoys meals out with friends, where they take turns covering the cost.

Insurance, a significant part of numerous American household budgets, is provided by her employer.

For her January budget, cab fares amounted to $277, placing them as the fourth-highest expenditure category. This might appear excessive—until one considers that it’s her main form of transport. A typical 90-minute ride to Muscat, which serves as Oman’s capital city, costs around $40 for her. She comments, “I doubt I could manage this level of expense back home in the U.S.”

Working to travel

By maintaining minimal expenditures, Brewer manages to accumulate savings sufficient enough to finance her travel desires. Her main employment also aids in this regard. Since Brewer receives payment throughout the entire year, she enjoys an absence from work during two of those months when school is not in session.

She mentions that she has two months of paid vacation. Whenever she travels, such as during the summer or winter breaks, her monthly salary remains unchanged.

Brewer manages to squeeze in several additional ventures, including serving as a travel consultant, running a blog, and doing freelancing writing. Altogether, these extra pursuits earned her approximately $3,400 in 2024, which was sufficient to support her beloved pastime.

She mentions that some of the earnings from organizing trips for others were funds she utilized for her own travels.

Additionally, having a part-time job in the travel sector comes with advantages.

I certainly managed to secure some travel benefits for certain trips,” Brewer states. “For instance, last summer, before coming back to the U.S., I went to the Maldives and received a complimentary hotel stay since I planned to write about them on my blog.

Despite her modest expenses and flexible workplace that facilitate traveling, Brewer finds herself postponing certain financial objectives like reducing her student loans due to her teacher’s income. In the future, she aims to increase both her savings and investment efforts.

But don’t expect her to stop traveling — or side hustling — any time soon.

“I realized just how much of a passion it is, and being able to be a writer and a travel influencer, I’ve been able to turn this passion into an income-earning opportunity,” she says. “So it’s like the best of both worlds. I get to travel and make money from it on the side.”

Do you want a new career that’s higher-paying, more flexible or fulfilling?

Sign up for their new online course now.

Ways to Switch Careers and Find More Job Satisfaction

Skilled mentors will guide you in mastering networking techniques, updating your CV, and transitioning smoothly into your ideal job. Begin now and apply the promo code EARLYBIRD to receive a 30% discount off the $67 fee (+ taxes and fees) until May 13, 2025.

Plus,

subscribe to Make It’s mailing list

To obtain advice and strategies for achieving success at your job, managing finances, and navigating everyday life.

Leave a Reply